Integrating SePay Transfer Code Scan Payment: A Comprehensive Transfer Solution

SePay QR Code Transfer Payment Integration: A Comprehensive Transfer Solution

In the context of the growing e-commerce landscape, optimizing the payment process is a key factor in enhancing customer experience and business efficiency. One of the increasingly popular payment methods is the integration of SePay QR code transfer payments. This method not only offers convenience and speed but also ensures high security.

Have you ever faced difficulties managing manual transfer transactions, or do you want to provide your customers with the most modern and easy payment options? This article will delve into explaining SePay QR code transfer payment integration, along with related services, helping you better understand this solution and how it can bring outstanding benefits to your business.

We will explore the definition, benefits, key components, implementation process, common mistakes, and answers to the most common questions about this transfer integration service.

Table of Contents

1. Introduction: What is SePay QR Code Transfer Payment Integration?

2. Outstanding Benefits of Integrating QR Code Transfer Payments

3. Key Components of the SePay Payment Integration System

4. Detailed Step-by-Step Integration Guide

5. Common Mistakes During Integration and How to Fix Them

1. Introduction: What is SePay QR Code Transfer Payment Integration?

SePay QR code transfer payment integration is the process of connecting a business's payment system with the SePay platform, allowing customers to make payments by scanning a generated QR Code. This QR code contains detailed payment information such as the account number, amount, and transfer description, enabling the transaction to be automatic and accurate.

Previously, transfer transactions often required users to manually enter bank information, which could easily lead to errors. SePay was created to solve this problem, providing a modern, secure, and efficient payment solution. SePay's transfer integration service allows businesses to customize QR codes as needed, thereby simplifying the money collection process.

The core features of this solution include:

- Dynamic QR code generation: A separate QR code can be created for each transaction with detailed information.

- Automatic payment confirmation: The system can automatically update the order status as soon as a successful transaction notification is received.

- Multi-bank support: Customers can use any bank application to scan the code and make the transfer.

- Detailed reporting: Provides transparent transaction reports, helping businesses easily manage cash flow.

If you are looking for an effective solution to manage payments, do not hesitate to explore our transfer integration service. Contact us at khaizinam.io.vn for detailed consultation.

2. Outstanding Benefits of Integrating QR Code Transfer Payments

Adopting SePay QR code transfer payment integration brings countless benefits to businesses of all sizes:

a) Increased Transaction Speed and Reduced Errors:

Customers only need a few simple steps to scan the code and confirm the payment. This significantly reduces waiting time compared to traditional methods. More importantly, automatic data entry almost completely eliminates the risk of incorrect account numbers, amounts, or transfer descriptions, which are common causes of transaction issues.

b) Enhanced Customer Experience:

The convenience, speed, and modernity of QR code payment create a positive impression on customers. They feel better served, and the business appears more professional and trustworthy. A smooth payment experience is a crucial factor in retaining customers.

c) Reduced Operating Costs:

With the ability to automate the payment confirmation process, businesses can save time and resources for employees. They no longer have to manually check each transaction and reconcile information, thereby reducing personnel costs and focusing on core business activities.

d) Increased Security:

SePay uses advanced security protocols to ensure the safety of every transaction. Payment information is encrypted, minimizing the risk of fraud and protecting the interests of both the seller and the buyer.

e) Expanded Payment Channels and Customer Reach:

Offering multiple payment methods, especially modern ones, helps businesses reach a wider range of customers. Customers today tend to prefer diverse and convenient payment channels.

f) Easy Management and Tracking:

The SePay system often comes with detailed reporting and transaction management tools. Businesses can easily review transaction history, track cash flow, and reconcile reports, making accounting and financial management more efficient.

To experience these benefits, choosing a reputable transfer integration service is very important. We provide a comprehensive solution to help your business successfully implement this. Learn more at khaizinam.io.vn.

3. Key Components of the SePay Payment Integration System

A SePay QR code transfer payment integration system typically includes the following components, working together seamlessly to create a complete payment solution:

a) The SePay Platform:

This is the heart of the system, providing APIs (Application Programming Interfaces) and SDKs (Software Development Kits) to connect with the business's system. The platform is responsible for processing QR code generation requests, receiving payment notifications, and managing the merchant account.

b) QR Code Generation Gateway:

This component allows the business to generate QR Codes. The QR code can be static (for fixed payments, e.g., an in-store QR code) or dynamic (for specific transactions, containing detailed order and amount information). The information encoded in the QR includes:

- Recipient account number

- Bank name

- Payment amount

- Transfer description (often an order ID or other unique identifier)

c) Payment Notification System (Webhook/Callback):

When a customer completes a transfer transaction via the QR code, the bank or e-wallet sends an automatic notification (usually called a webhook or callback) to the business's system. This notification contains confirmation of the successful transaction, helping the business's system update the order status (e.g., marking the order as "Paid").

d) Order/Revenue Management Interface:

This is the section used by the business to monitor transactions, view revenue reports, manage orders, and reconcile information. This interface is often provided by SePay or integrated into the business's existing sales management system (POS).

e) Customer's Bank/E-wallet Application:

This is the tool used by the end-user to execute the payment. They use the QR code scanning function in their application to read the information from the QR code and proceed with the money transfer.

The harmonious coordination of these components creates a seamless payment process. If your business is struggling to integrate payment solutions, please contact us for support. We provide professional transfer integration services. Find out more at khaizinam.io.vn.

4. Detailed Step-by-Step Integration Guide

To deploy SePay QR code transfer payment integration, businesses need to follow these steps:

Step 1: Register a SePay Account and Obtain API Information

First, you need to visit the SePay website or contact the sales department to register a business account. After the account is approved, you will be provided with the necessary information for API connection, including the API Key, Secret Key, and API Endpoints.

Step 2: Choose the Integration Method

SePay typically offers various integration options:

- Integration via SDK: If the business has a development team, using the SDK will allow for quick and flexible integration into the web or mobile application.

- Integration via API: Suitable for more complex systems, allowing deep customization according to business requirements.

- Integration via ready-made Plugin/Module: For popular e-commerce platforms (like WooCommerce, Shopify), SePay may provide pre-installed plugins or modules, making the integration process much simpler.

Step 3: Develop the QR Code Generation Functionality

Within your order management system, you need to develop the QR code generation functionality. When a customer chooses to pay by QR code, the system will call the SePay API to request the creation of a dynamic QR code containing the order information (amount, description). This QR code will then be displayed to the customer.

Example illustration: When a customer orders Product A for 100,000 VND, the system will send a request to SePay to create a QR code with the information: Amount: 100,000, Content: DH12345. This QR code will be displayed on the payment screen.

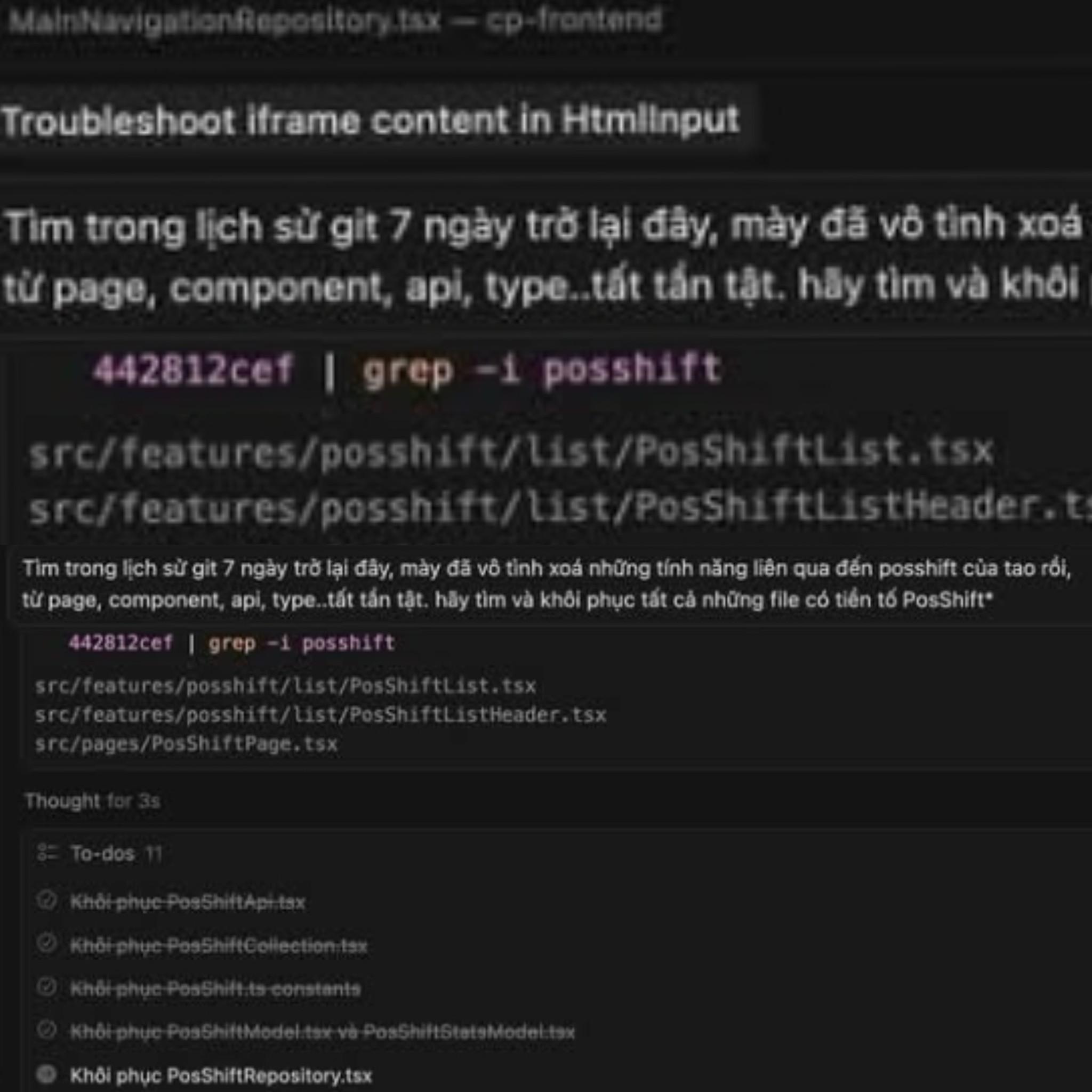

Step 4: Handle Payment Notifications (Webhook)

You need to set up a URL on your server to receive notifications from SePay when the transaction is complete. When SePay sends the successful payment information to this URL, your system will process the received data, verify its validity, and update the order status to "Paid".

Step 5: Testing and Official Operation

After completing the integration, thoroughly test with actual transactions (using a test account or small amounts). Ensure all functions work as expected. Once everything is stable, you can launch the system for official operation.

If you need specialized support for website integration or automated payment solutions, please contact us at khaizinam.io.vn.

5. Common Mistakes During Integration and How to Fix Them

During the deployment of SePay QR code transfer payment integration, many businesses make unnecessary mistakes. Below are common errors and how to fix them:

1. Lack of Understanding of the API and Technical Documentation:

Cause: Lack of experience or neglecting to thoroughly read the documentation from SePay.

Solution: Spend time studying the API documentation, and refer to available examples. If necessary, hire an expert to assist with the integration.

2. Weak API Key Security:

Cause: Storing the API key publicly or sharing it with unauthorized individuals.

Solution: Store the API key in a secure location, use second-layer security measures, and only provide it to those who genuinely need it.

3. Unreliable Webhook Notification Handling:

Cause: The system fails to handle network errors, server downtime, or does not verify the integrity of the webhook data.

Solution: Build a webhook processing mechanism with a retry mechanism, validate the webhook signature to ensure the data originates from SePay, and log incidents in detail.

4. Skipping Comprehensive Testing:

Cause: Rushing to deploy without thoroughly testing various scenarios.

Solution: Plan detailed testing, including success, failure, large transactions, small transactions, and unexpected scenarios.

5. Failure to Provide Clear Information to Customers:

Cause: Confusing payment interface, lack of instructions for using the QR code.

Solution: Design an intuitive payment interface, clearly display the QR code, accompanied by brief scanning instructions and necessary notes.

6. No Mechanism to Handle Errors:

Cause: The system lacks error notifications for users or staff when an incident occurs.

Solution: Build an automatic error alerting system and a clear incident handling process for the operations team.

7. Forgetting to Update Bank Information:

Cause: Changing bank account information without updating it in the SePay system.

Solution: Establish a regular process for checking and updating bank account information on the SePay platform.

Avoiding these mistakes will help the transfer integration process go smoothly and yield the highest efficiency. If you need consultation on transfer integration services, please contact us at khaizinam.io.vn.

6. Frequently Asked Questions (FAQ)

Q: Is SePay QR code payment integration costly?

A: The cost of SePay integration depends on the service package you choose and the level of customization required. SePay typically offers service packages with competitive pricing. You should contact SePay's sales department directly to receive a detailed quote for your needs.

Q: Can I integrate SePay myself without an expert?

A: If you have a technical team familiar with APIs and programming, self-integration is entirely possible, especially if SePay provides an SDK or plugin for the platform you are using. However, to ensure stability and security, seeking support from professional transfer integration service providers is a safer choice.

Q: Are the QR codes generated by SePay safe?

A: Yes, the QR codes generated by SePay are designed to be secure. The information within the QR code is encrypted and can only be used for the predetermined payment purpose. SePay also implements security measures to guard against various forms of fraud.

Q: Which bank applications can customers use to pay with SePay's QR code?

A: Customers can use most popular bank applications in Vietnam that have a built-in QR code scanning function to make payments. SePay supports linking with many major banks.

Q: After a customer pays, do I receive an immediate notification?

A: Yes, the SePay system is designed to send a successful payment notification almost immediately via the webhook mechanism. However, the time it takes to receive the notification may be affected by the bank's processing speed or network connection issues.

Q: Can I customize the content within the QR code?

A: Yes, you can absolutely customize the transfer description displayed in the QR code. This content usually includes the order ID or a unique identifier for the transaction, making reconciliation easier for you.

7. Conclusion: Elevating the Payment Experience with SePay

SePay QR code transfer payment integration is not just a trend but a strategic move that helps businesses modernize their payment process, enhance operational efficiency, and build a competitive advantage. From simplifying transactions for customers to automating confirmation processes for businesses, SePay provides a comprehensive and effective solution.

We offer professional transfer integration services, helping your business easily deploy and maximize the benefits of the QR code payment solution. Don't let outdated payment methods hinder your growth.

Contact us now at khaizinam.io.vn for a free consultation and start your journey to upgrade your business's payment experience!

Chia sẻ bài viết

Bình luận

Chia sẻ cảm nghĩ của bạn về bài viết này.